This was my first Alt-Tech Opinion for BlockTV News.

Welcome back to BlockTV. I’m Brian of London and this is my alt-tech opinion for BlockTV on the 3rd of February 2020.

It is a truth, universally acknowledged, that the big tech giants, Google, Facebook, Amazon and Apple have too much power and control. Whether that’s a problem or not seems to be related to the size of your slice of their massive lobbying budgets.

The Antitrust Subcommittee of the US House Judiciary Committee is currently working on an investigation and a couple of weeks ago the committee took time out from impeaching Trump to continue doing something useful, perhaps. They held a field hearing about the power of online platforms and spoke to witnesses specifically about Facebook, Google Amazon and Apple.

This was part of their investigation into the competitiveness of digital markets: this is a bipartisan investigation which will generate a report and recommendations for new laws and regulations seeking to govern how big tech platforms work.

This meeting took testimony, under oath, from four witnesses1. All four told compelling stories of how difficult it is to innovate in a market dominated by companies which have grown so huge. Throughout I heard a clear tension between business people who want government to get out of the way and let them innovate, against a recognition that Google, Facebook, Apple and Amazon have grown unnaturally large and are now a threat to innovation.

This is David Heinemeier Hansson, the CTO of software service provider Basecamp.

[Video]

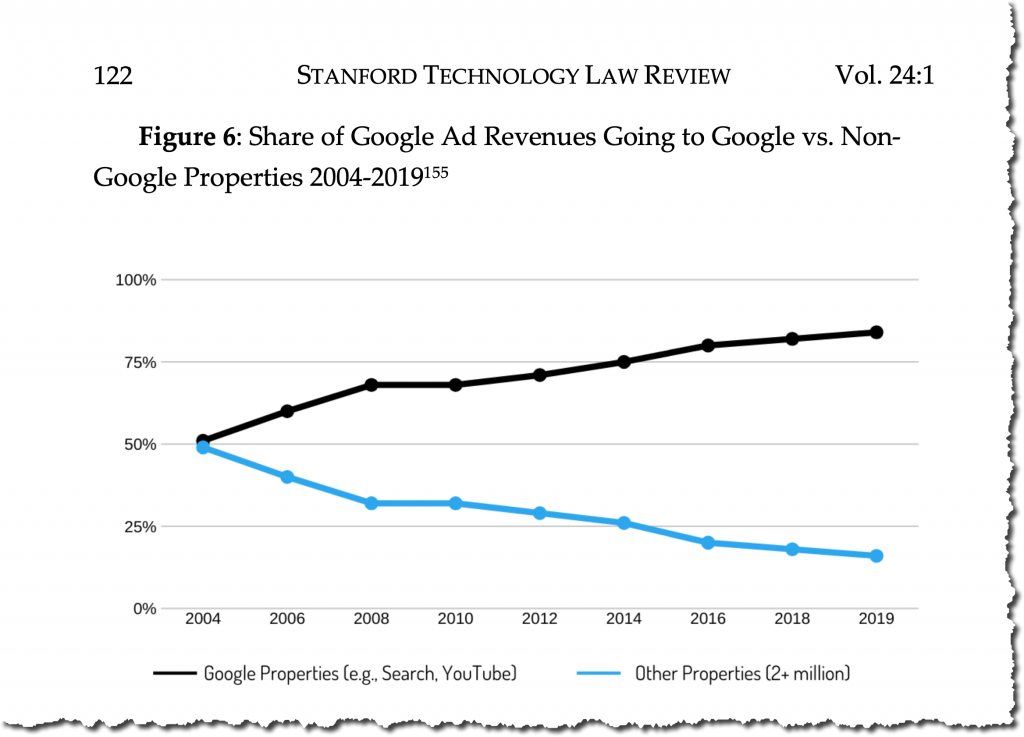

It was very clear in all of those tests that Facebook was by far and away the most effective way to market because of the immense amount of personal data that they have so we could target our apps to just an astonishing degree and no other advertising platform was able to compete and this is why Google who also has the same sort of capabilities of charging and Facebook is able to capture 99% of all growth in Internet advertisement as was stated in that report from 2016 because they simply have devastatingly effective machinery.

He’s arguing, and I’m in complete agreement, Facebook and Google managed to collect and gather a trove of personal information in an early gold rush. Most people had no idea they were handing over something this valuable in aggregate because individually they either thought it a fair exchange for free email, photo sharing with grandma and some shiny beads or they simply never thought of it. Apple and Amazon are sitting on similar power.

As these giants grew quickly, the incumbents in the advertising market, whose business they were eating, didn’t see it coming. Back in 2010 now prominent crypto invester, Lou Kerner, made what seemed like a wild prediction for Facebook advertising revenue in 2015 and that Facebook would come to dominate online advertising and how online advertising would dominate advertising in general.

[Video 48s]

Facebook hit his prediction about 18 months after his prediction but this was still wild growth.

I have worked on and run many websites since before Facebook started up until today: especially in news and opinion, Facebook can easily send 70% of a site’s traffic. Whether you’re buying adverts using their astonishingly intrusive targeting data, or just trying to have your thoughts heard, Facebook is the giant you can’t ignore.

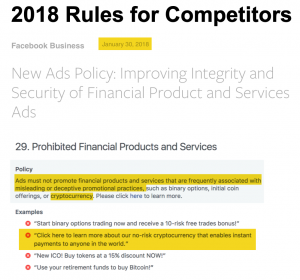

For the crypto world, we can’t ignore Facebook’s January 2018 ban on crypto advertising and their casting of cryptocurrencies as a “frequently associated with misleading or deceptive practices”.

[Read]

Ads must not promote financial products and services that are frequently associated with misleading or deceptive promotional practices, such as binary options, initial coin offerings, or cryptocurrency.

Google and Twitter copied this weeks later. This attack on an entire industry that may one day compete with these incumbent giants doesn’t appear to have been illegal in America (though it may have broken Australia’s anti-cartel laws).

America doesn’t really have the same anti-trust regulations as Australia which is a pity. Even now the politicians don’t seem to know what to do next. Toward the end of the hearing the politicians ask the panel what they suggest: the short version is they really don’t know what to do about it.

Speaking in a separate interview to the Verge2, committee chairman David Cicilline said this:

[Audio 36s]

This is not an investigation that results in an enforcement action investigation.

Congress is the only place that has the ability to actually change the statutes and update the laws and put proposed regulations in place that actually fix this marketplace. So unlike an enforcement action that focuses on the behavior — a single company gets directed to do a single thing — our work is much broader. And it is actually more significant because if we do it right, we can get this digital marketplace working properly. And that will benefit consumers. It will benefit the next great company that’s going to come down the pike because competition was possible.

The US Government is slowly coming to terms with the dramatic concentration of power which has happened to social media, online advertising, local, national and international news, retail sales and the distribution of apps on our phones, the most important communication devices in the world. It didn’t happen overnight, but it happened to fast than for governments.

But for those of us with the ear to the ground in the crypto world, where suspicion of big government and their regulations is real and well founded, how do we feel about whatever this committee will propose? Does anyone think US authorities have done a great job regulating crypto? Can we place most of their efforts in the category of mostly harmful?

If you’ve got an opinion, look me up on twitter @brianoflondon or @brianoflondon on Steemit. Tell me know what you think.

For now, that’s Brian’s Alt-tech opinion.

1 https://judiciary.house.gov/calendar/eventsingle.aspx?EventID=2386

2 https://www.theverge.com/2020/1/23/21078903/podcast-house-antitrust-chairman-cicilline-tech-monopoly-vergecast

You must be logged in to post a comment.