A few headlines for the progress JPB Liberty has made in our Crypto Ad ban class action case against Facebook, Google and Twitter:

- Since July 1st the financial value of submitted claims has jumped from $30m to over $200m and are still streaming in;

- We have more than 350 claimants;

- We’re in discussion with established sources of funds for class action legal cases;

- Significant private contributions to legal funds;

- Written acknowledgement of our warning letter from Google Australia;

- Significant press coverage.

We’ve gained more press coverage and sign ups to the suit have accelerated. People, especially Crypto insiders, are realising that what the tech Goliath did, by calling their entire industry a scam, was very wrong!

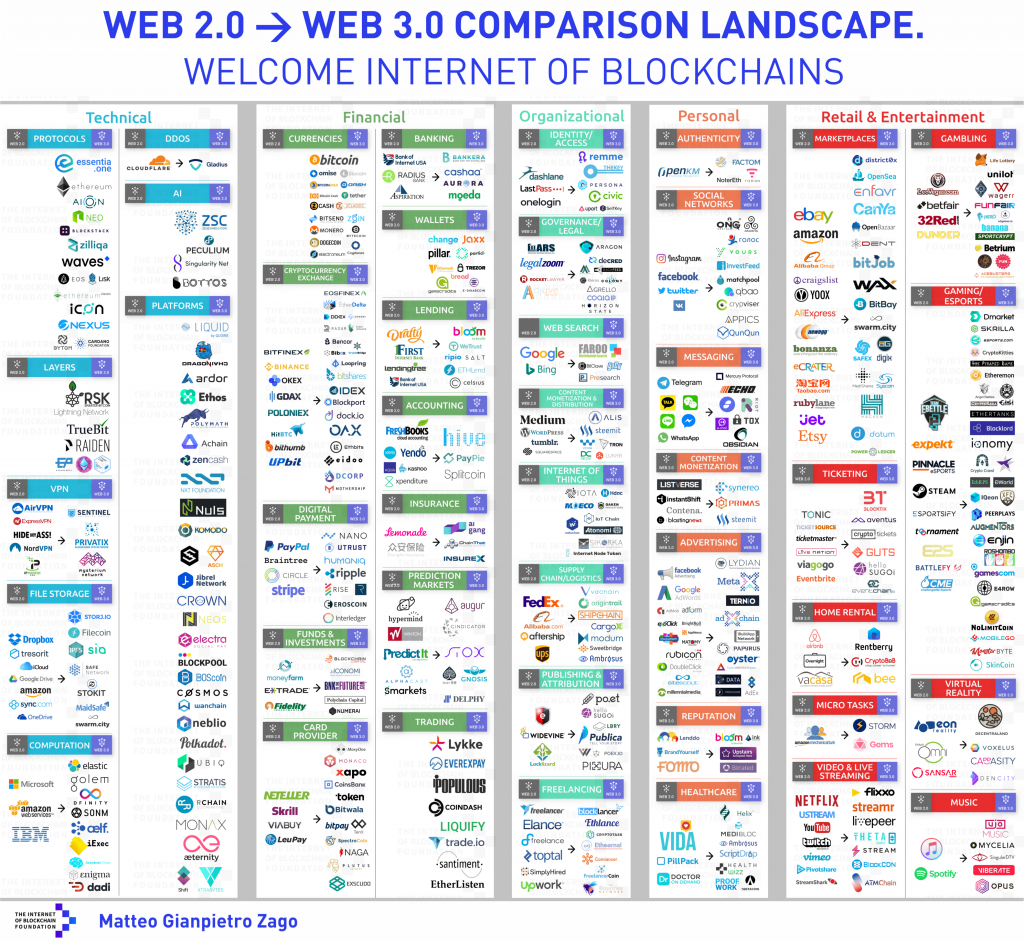

Up until now there seems to have been a sort of Stockholm syndrome mentality within crypto insiders. Some crypto insiders believe there were lots of scams and the whole industry needed to feel guilty about them. They just took the punishment from these huge mega corporations and felt they deserved some of it! Evidence just doesn’t back this up. We have to fight that mentality which seems to be a very strongly held belief in a myth. You can read more about why this is a hoax here.

This article in Decrypt contains a very interesting revelation from a Facebook spokesperson:

While the suit names Facebook, Google and Twitter directly, Hamilton said he considers Facebook the principle offender, and alleged that the tech giant instigated the ban.

In comments to Decrypt, a Facebook spokesman who did not want to be quoted by name said the social network would look into any cases where unfairness is alleged. The spokesman added that the initial ban had been intentionally broad to better understand the crypto market; the intent had been to create clearer policy around what constitutes acceptable crypto advertising.

Decrypt – Sued for billions, Facebook is accused of killing crypto businesses by Ben Munster

The spokesman

added that

the initial

ban had been

intentionally broad

to better

understand the

crypto market;

Does this phrase: “the initial ban had been intentionally broad to better understand the crypto market” mean Facebook decided to ban an entire industry before they even understood it? That would be an astonishing admission. Or are they just gaslighting now?

In the meantime JPB Liberty has received an acknowledgement of our initial letter sent to Google in Australia. They confirmed Google Australia was talking with Google in the US and a few other details.

We were also covered by Nadja Bester of BeInCrypto with an excellent and detailed explanation of the case.

This video I recorded in Jerusalem was especially good at driving sign ups to our case.

Not directly connected with JPB Liberty’s case (but I did mention the Crypto Add Ban) I appeared on Block TV again talking about Brexit and Bitcoin.

If you want to join the fight, instructions below. We’re always looking for class members as no-win-no-fee participants and at the same time, if you want a financial stake in this project, you can send money by PayPal or various crypto and you will receive a cryptographic token representing your share in the damages.

You can join the fight against the Tech Goliaths in two ways, you have a no win no fee claim or you wish to help finance the case.

⭐️ Please join the case if you held crypto and have a claim.

🏅 You can directly contribute crypto on Fundition. To send fiat currency via PayPal click here. If you want to talk about a large donation, Telegram or email me.

If you derive value from my work, please consider donating some value my way. You can find all the details on the donation page.

You must be logged in to post a comment.