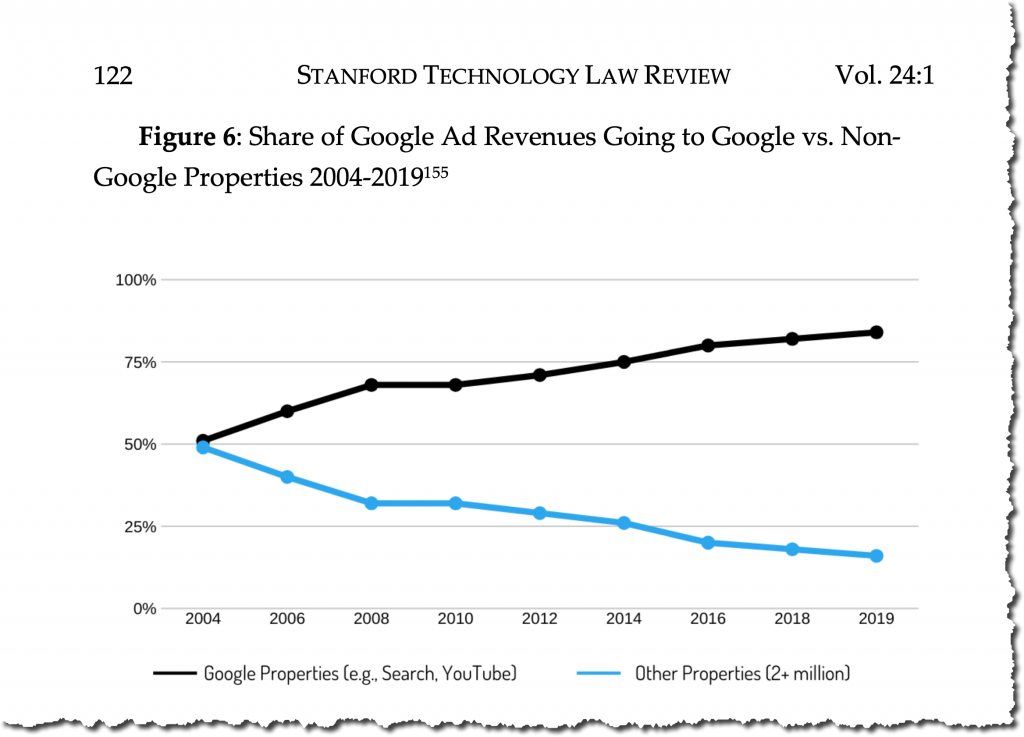

Google is eating everybody else’s lunch. The share of Advertising revenue that Google passes back to the content owners whose content their entire business is built on the back of, has steadily gone down. This was deliberate and they knew what they were doing.

That graph is explained in the following footnote and you can read more about the paper from which it is taken at this link:

In Google’s annual 10-K SEC filings, Google breaks down its advertising revenue as going to “Google properties” or “web sites of Google Network members.” The term “Google Network members” refers to non-Google websites on which Google places advertising. In its 2017 10-K, Google explains that it generally accounts for third-party revenue on a gross basis: “For ads placed on Google Network Members’ properties, we evaluate whether we are the principal (i.e., report revenues on a gross basis) or agent (i.e., report revenues on a net ba- sis). Generally, we report advertising revenues for ads placed on Google Net- work Members’ properties on a gross basis, that is, the amounts billed to our customers are recorded as revenues, and amounts paid to Google Network Members are recorded as cost of revenues. Where we are the principal, we control the advertising inventory before it is transferred to our customers. Our control is evidenced by our sole ability to monetize the advertising inventory before it is transferred to our customers, and is further supported by us being primarily responsible to our customers and having a level of discretion in establishing pricing.” In 2004, Google buying tools allocated approximately 50% of advertising revenue to Google’s proprietary properties, such as Search, and the other 50% to non-Google websites selling their ads through Google’s buying tools and advertising exchange. Google Inc., Annual Report (Form 10-K) (Mar. 30, 2005), https://perma.cc/5A4Y-8EY4. It was in 2006 that Google acquired YouTube. An- drew Ross Sorkin & Jeremy W. Peters, Google to Acquire YouTube for $1.65 Billion, N.Y. TIMES (Oct. 9, 2006), https://perma.cc/5TG8-8BVE. In 2005, Google’s share of advertising revenue increased to, approximately, 55%; 2006, 60%; 2007, 65%; 2008, 68%; 2009, 68%; 2010, 68%; 2011, 71%; 2012, 71%; 2013, 73%; 2014, 75%; 2015, 77%; 2016, 80%; 2017, 81%, 2018, 82%; 2019, 84%. Google Inc., Annual Report (Form 10-K) (Mar. 16, 2006), https://perma.cc/Y272-BRAP; Google Inc., Annual Report (Form 10-K) (Mar. 1, 2007), https://perma.cc/H4ZJ-FL7B; Google Inc., Annual Report (Form 10-K) (Feb. 15, 2008), https://perma.cc/W6FU-AA2T; Google Inc., Annual Report (Form 10-K) (Feb. 13, 2009), https://perma.cc/5PZY-UZS5; Google Inc., Annual Report (Form 10-K) (Feb. 12, 2010), https://perma.cc/7B6E- REEV; Google Inc., Annual Report (Form 10-K) (Feb. 12, 2011), https://perma.cc/9ZKX-XPKL; Google Inc., Annual Report (Form 10-K) (Apr. 23, 2012), https://perma.cc/YS3R-TLE4; Google Inc., Annual Report (Form 10-K) (Jan. 29, 2013), https://perma.cc/3W45-M9R9; Google Inc., Annual Report (Form 10-K) (Feb. 11, 2014), https://perma.cc/79A2-6TCT; Google Inc., Annual Report (Form 10-K) (Feb. 6, 2015), https://perma.cc/7DJZ-FD8S; Google Inc., Annual Report (Form 10-K) (Feb. 11, 2016) https://perma.cc/EU2M-T6QC; Alphabet Inc., Annual Report (Form 10-K) (Feb. 2, 2017), https://perma.cc/4QKP-UUZJ; Alphabet Inc., Annual Report (Form 10-K) (Feb. 5, 2018), https://perma.cc/22HL-SSSP; Alphabet Inc., Annual Report (Form 10-K) (Feb. 4, 2019), https://perma.cc/ELZ2-AC93; Alphabet Inc., Annual Report (Form 10-K) (Feb. 3, 2020), https://perma.cc/RWE8- 27PB.

You must be logged in to post a comment.